NOTE: Only transactions that are in an open period are able to be edited.

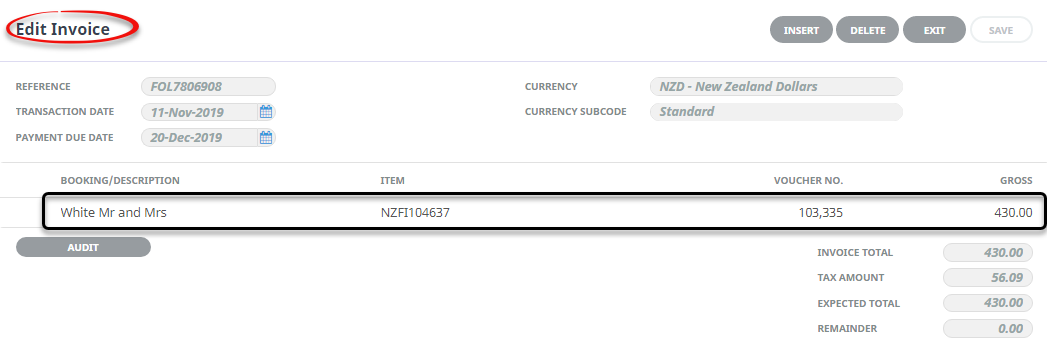

Select the invoice to be edited from the Creditors Transaction List. The Edit Invoice screen will display.

NOTE: The transaction lines are display only in this screen. To edit the line detail, click a transaction line. This will open the Invoice Line Detail screen.

Transaction Lines

Booking/Description

Description line 1 from the Invoice Line Detail screen.

Item

This is either a) in the case of Booking Transactions, the Booking reference, or b) for non-bookings transactions, the transaction reference (invoice) number.

Voucher

The voucher number from the Invoice Line Detail screen as above.

Gross

The gross value of the transaction line from the Invoice Line Detail screen.

Edit an invoice

-

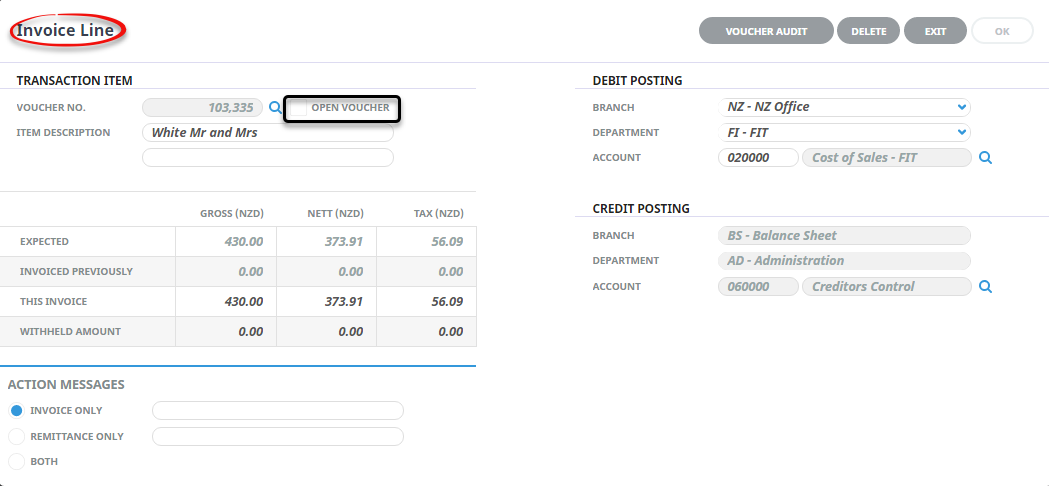

Selecting the Transaction line will open the following

Invoice line screen:

Invoice line screen:

-

When editing is completed, click

OK. This will re-display the Edit Invoice screen.

OK. This will re-display the Edit Invoice screen.

-

To continue adding lines to the Invoice, click

Insert.

Insert.

-

To Save, click

Save.

Save.

NOTE: When Exit or Save are clicked, the Creditors Transaction Scroll screen will display and the creating or editing of a Creditors Invoice is complete.

-

To delete a complete invoice, highlight the invoice in the Transaction List scroll and click

Delete.

Delete.

Transaction Item

This section displays the transaction detail. Some fields in this area can be edited if required.

Voucher Number

The voucher number cannot be changed.

Close Voucher (Checkbox)/Open Voucher (Checkbox)

This has inherited the setting from the Close checkbox in the tag vouchers screen. If the voucher is not to be closed, uncheck the box. This checkbox heading becomes "Open Voucher" when opening an already saved invoice.

Item Description (2 Fields, 60 Chars each)

The booking name is automatically written to the first description field. This can be edited and additional text can be entered in the second field if required.

Expected (Gross, Nett, Tax) (Display Only

These three fields display the vouchered amount that was expected to be paid.

Invoiced Previously (Gross, Nett, Tax) (Display Only

These fields display any amount for this voucher which has been previously invoiced.

This Invoice (Gross, Nett, Tax) (Numeric, 12.4)

These fields show the amount that was entered or selected in the tag vouchers screen. They can be overwritten.

Withheld Amount (Gross, Nett, Tax) (Numeric, 12.4)

If an amount is being withheld from the supplier—i.e., an amount in dispute that may be paid at a later date — then the amount being withheld can be entered in these fields. Withheld amounts can be released for payment or crediting (see Accounts 2 User Manual, A.P. Release Withheld Amounts).

NOTE: When an amount is being withheld, the full amount (including the amount to be withheld) must be entered in the This Invoice field, and the amount being Withheld entered in the Withheld fields. Withheld amounts should not be confused with short payments. If the expected/vouchered value is 100.00 and the supplier sends an invoice for 80.00, then the 20.00 residual is not a withheld amount, it is an under payment and the voucher can be closed. If the expected/vouchered value is 100.00 and there is a dispute over 20.00 of the invoice, then the 20.00 is a withheld amount.