A credit note can be applied against a previously entered creditor’s invoice.

NOTE: Tourplan Accounting is "Open Item" which means that a Credit (or Cheque) transaction must relate to an Invoice transaction. Credit Notes can only be applied against an already existing invoice.

Create Credit Note Transaction

- Make sure the required creditor / supplier is displayed (see Retrieve an Existing Creditor).

-

From the Creditors menu, select

Accounting > Transactions.

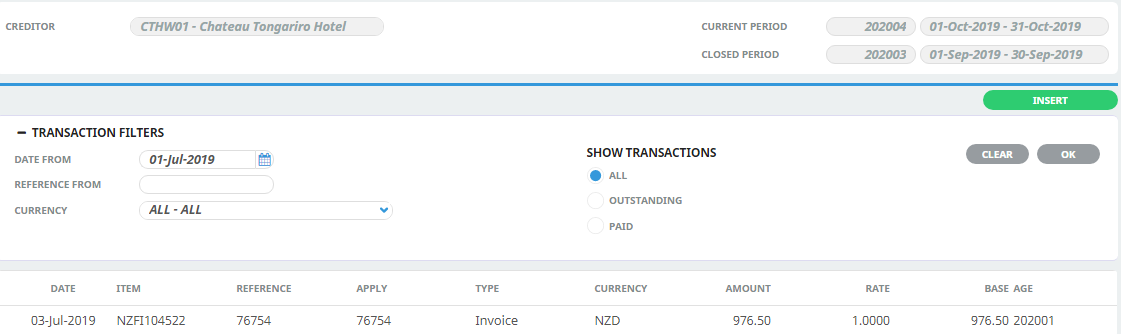

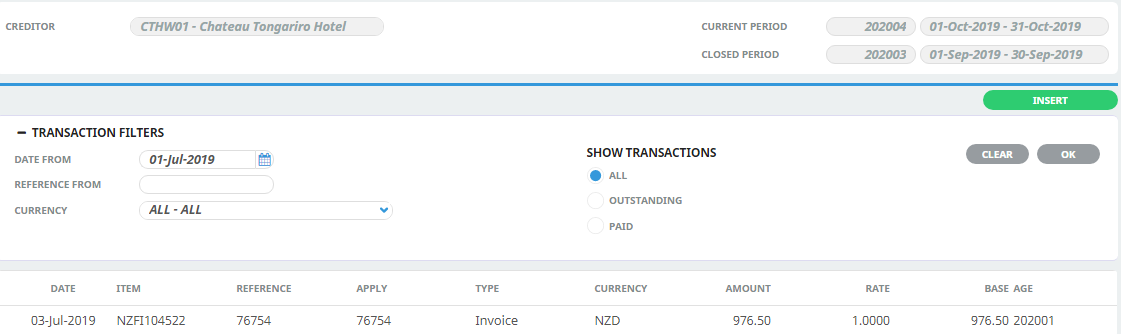

For example, the transactions list screen for CTHW01 - Chateau Tongariro Hotel.

Accounting > Transactions.

For example, the transactions list screen for CTHW01 - Chateau Tongariro Hotel.

Remember to apply Transaction Filter selection criteria; e.g. set the Date From back far enough to retrieve the required transaction(s).

-

On the Creditors transactions list screen, click

Insert.

Insert.

-

On the

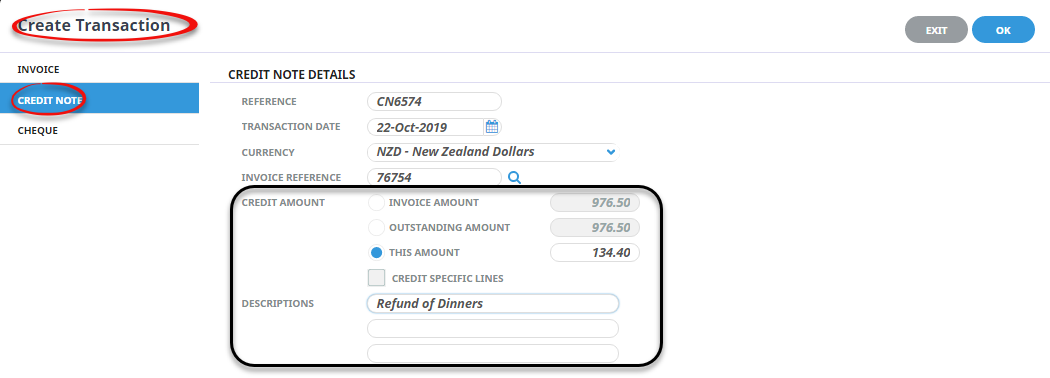

Create Transaction screen, select Credit Note as the type of transaction and enter details accordingly.

Create Transaction screen, select Credit Note as the type of transaction and enter details accordingly.

.png)

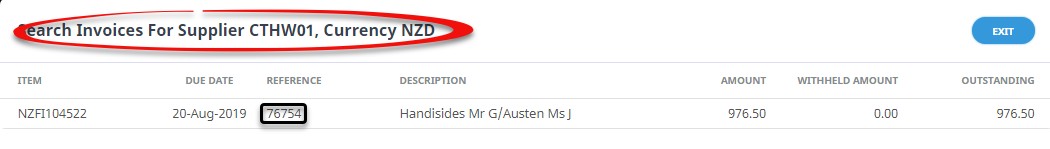

For example, searching for Invoice Reference 76754.

or alternatively, leave the Invoice Reference blank and click the Search glass.

NOTE: When the Creditors Invoice has been located, check either the Invoice Amount, Outstanding Amount or This Amount for the Credit Amount.

-

Click

OK to keep the changes and save or update the entry.

OK to keep the changes and save or update the entry.

-

Click

Exit to discard any changes.

Exit to discard any changes.

-

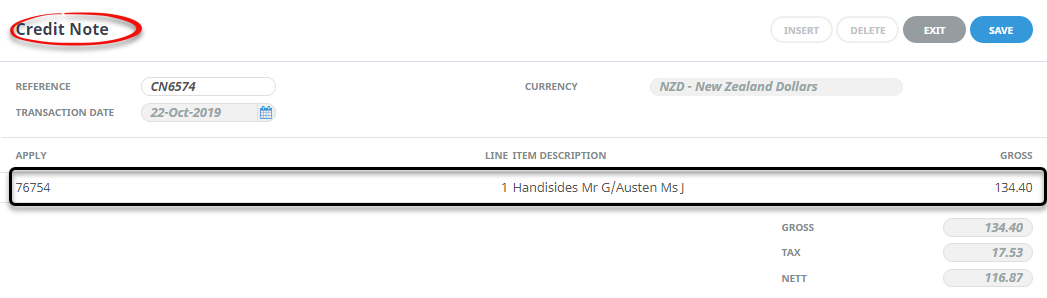

If OK is clicked, the

Credit Note screen appears:

Credit Note screen appears:

This screen also displays when a credit note is issued for the Invoice Amount or the Outstanding Invoice Amount and OK is clicked.

About the Create Credit Note Transaction Fields

Create Transaction (Credit Note) fields

Credits can be applied against the invoice total or against a specific line of an invoice.

NOTE: The three Radio Button fields Invoice Amount, Outstanding Amount and This Amount control the amount that will be applied against the Credit Note total. The Check-box Credit Specific Lines controls applying the credit amount at invoice line level.

Reference (20 Chr)

The Credit Note number. This is the number of the credit note received from the supplier.

Transaction Date (Date)

Credit Note transaction dates always default to current system date. The transaction date can be overridden.

The Transaction Date must be in an open accounting period—the system will not allow a transaction date which is in a closed accounting period.

Credit Notes always inherit the age period of the invoice to which they are applied.

Currency (Dropdown)

The currency that the credit will be issued in. This can be changed to any of the currencies that are attached to the supplier. The currency which was checked as the default in the currencies screen during supplier set up is the one which displays by default.

Invoice Reference (20 Chr, Search Button)

If the reference of the invoice being credited is known, it can be entered in this field. If the reference is unknown, clicking the Search button will list invoices (in the Credit Note Header currency) that are available for credit.

When an invoice line is selected for credit, by default the system will calculate the credit value to be the outstanding amount of the line. This is calculated as the invoice value less the value of any cheques that have been applied to the invoice.

Credit Amount (Radio Buttons, Checkbox)

The fields in the Credit Amount section are:

- Invoice Amount - This will display the value of the invoice selected.

- Withheld Amount - Displays any amount withheld from the supplier which can be credited.

- Outstanding Amount - This field displays the residual value of the invoice after any payments or credits have been made.

- This Amount - Selecting this radio button allows a value to be inserted.

- Credit Specific Lines - If Invoice Amount or Outstanding Amount check boxes are selected, Credit Specific Lines becomes live and when ok is clicked, can be selected.

NOTE: This field only displays when a Withheld amount is detected on the invoice being credited.

Descriptions

If required, 3 fields of 60 characters each are available to describe the reason for the credit.

NOTE: These description fields relate to the Credit Note and are not the same as the description fields which are available in the Credit Note line screen which relate specifically to the credit note line.

An example of the Creditors Credit Note dialogue:

Credit Note dialogue fields

Reference, Transaction Date and Currency

Refer Create Transaction (Credit Note) fields.

Apply

Is the invoice number selected for the Credit Note to apply to.

Line

This is the line number of the invoice the credit applies to.

Item Description

When a selection has been made by Line Number, the original description text is defaulted to these lines. Two lines are available for text detail of the item. The description lines can be overridden.

NOTE: These description fields default from the original invoice lines. They are different description lines to the 3 lines available in the Credit Note header.

Gross

Unless an amount has been entered into the 'This Amount' field in the transaction header screen, This will default to the total value of the invoice or invoice line being credited—the presumption being that the full value is being credited. This value can be overridden.

Tax

The total value of the tax amount being applied against the invoice or invoice line being credited.

Nett

The nett value (Gross less tax) of the amount being applied against the invoice or invoice line being credited.