This process transfers the balances of G.L. Revenue and Expense accounts (P & L accounts) to the G.L. Retained Earnings (Balance Sheet account).

The process is run after the last period of the financial year has been closed, and for preference, it should be processed in period 1 of the new financial year.

NOTE: Profit transfers are effectively a G.L. journal, and as such abide by the rules accompanying G.L. journal postings. The balances for the year-end transfer are always As at Year-end NNNN — i.e., the balance figure is never calculated as at the end of the last closed period. If the year-end transfer is run in the new year, (e.g.), period 03, then the Balance Sheet Net Assets vs. P & L Year To Date Profit will be out of balance by the amount of the transfer in the new financial year periods 1 and 2. These circumstances are why the Lock G.L. Period function (see Lock (G.L.) Period) was designed. With the G,L. locked for period 12 last financial year, no Debtor or Creditor transactions can be posted to the previous year to distort the Revenue or Expense balances.

Processing a Profit Transfer

-

From the Home Menu select.

Financials > Accounting > General Ledger > Profit Transfer.

Financials > Accounting > General Ledger > Profit Transfer.

-

The

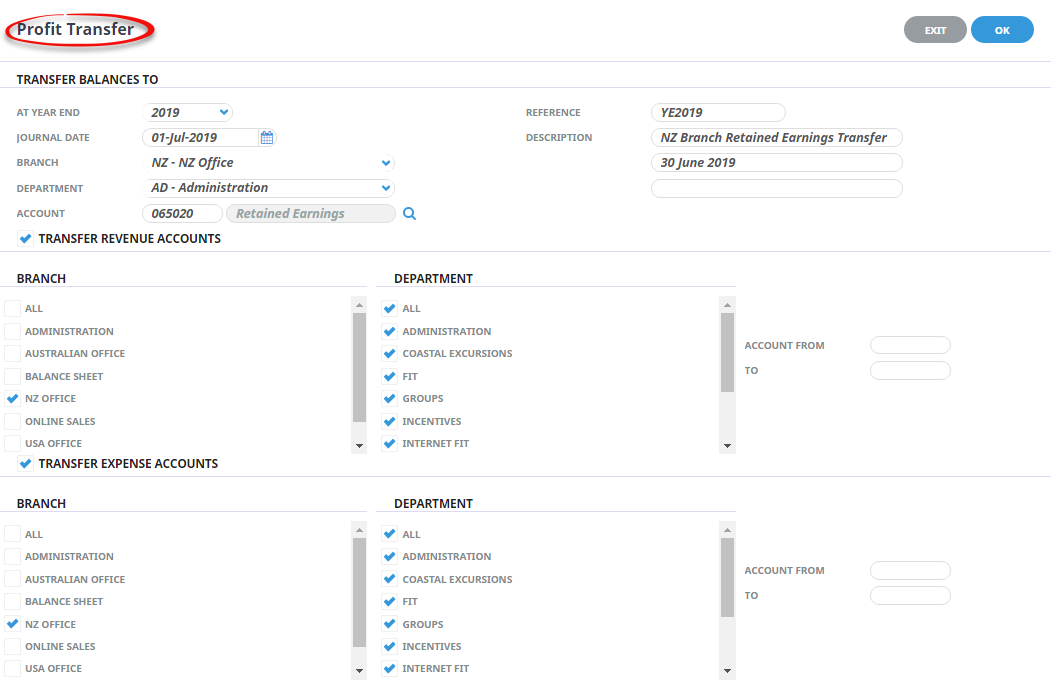

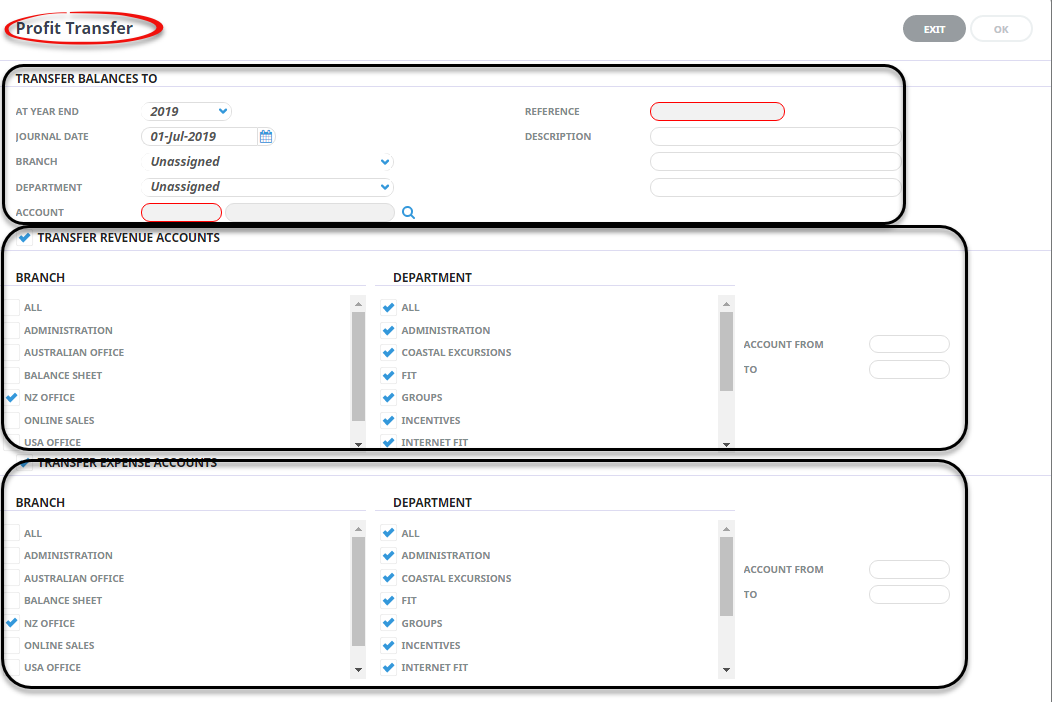

Profit Transfer screen will display.

Profit Transfer screen will display.

-

Click

OK to keep the changes and save or update the entry.

OK to keep the changes and save or update the entry.

-

Click

Exit to discard any changes.

Exit to discard any changes.

-

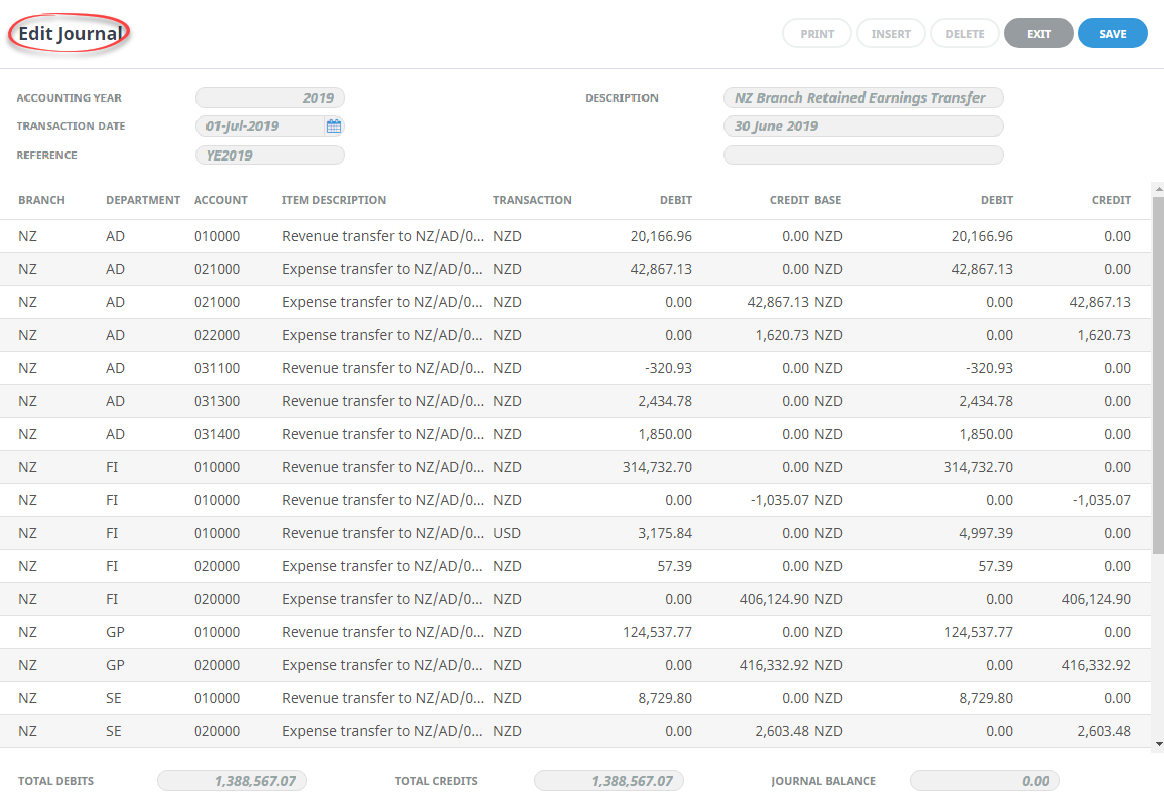

The journal lines are created as debits or credits against the various revenue/expense accounts selected. The balancing entries to the retained earnings account are shown in the bottom section of the list within the

Edit Journal Screen.

Edit Journal Screen.

NOTE: The application heading has changed from Profit Transfer to Edit Journal, indicating that standard editing journal functions are now available.

-

Click

Save to keep the changes.

Save to keep the changes.

-

Click

Exit to discard any changes.

Exit to discard any changes.

-

To print the Journal, click

Print

Print

.

.The report can be downloaded in pdf or csv format.

About Profit Transfer Screen

Transfer Balances To Section

At Year-End (Drop-down)

This field determines which financial years revenue/expense balances are to be transferred to retained earnings. On entry to the screen, the G.L. current period year defaults. Select the correct year from the drop-down.

Journal Date (Date)

This date will determine the transaction period of the journal and should be a date in period 01 in the new financial year.

Branch/Department/Account (Drop-downs, field)

Select or enter the Retained Earnings account, or use the Search button ![]() to find the correct Retained Earnings account.

to find the correct Retained Earnings account.

Reference (Chr 20)

Enter a reference for the year-end journal.

NOTE: If automatic journal referencing is being used, then any reference entered here will be discarded and the next journal number will take precedence when the journals are created.

Description (3 fields, Chr 60 each)

Enter up to 3 lines of descriptive journal text.

Transfer Revenue Accounts Section

Branch/Department/Account (Check-boxes, from/to field)

Check the Branch and Department combinations whose Revenue account balances are to be transferred. When checked, the multi-select list checkboxes can be used (if required) to filter the range of accounts from which revenue will be transferred to retained earnings.

Transfer Expense Accounts Section

Branch/Department/Account (Check-boxes, from/to field)

Check the Branch and Department combinations whose Expense account balances are to be transferred. When checked, the multi-select list checkboxes can be used (if required) to filter the range of accounts from which expenses will be transferred to retained earnings.

NOTE: Revenue and Expense accounts are those whose classification in the General Ledger account setup has been set up as either (R)evenue or (E)xpense.