Supplier currencies are added and maintained via the Currencies Tab.

Creditor currencies are specific to the Creditor and include details relating to currency, such as:

- Taxes

- Default Expense Account

- Creditor Payment Terms

- Deposit Required Terms

- Bank Account details

Enter Currency Details

- If the supplier to which details are to be added does not exist, create the supplier first (see Creating New Creditors).

- If the supplier does exist, search for and retrieve it, so that creditor details are displayed on the screen (see Retrieve an Existing Creditor).

-

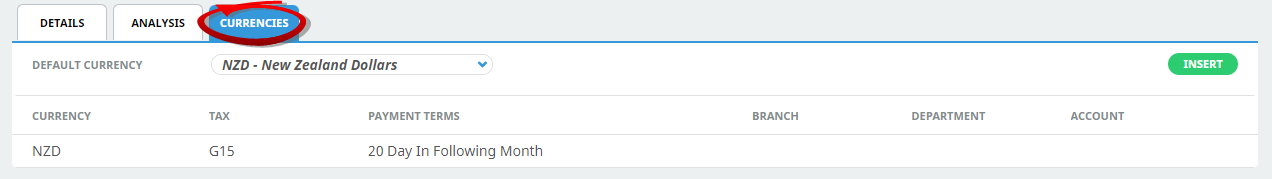

Click the

Currencies tab. For a new creditor, the Default Currency which was added on the Insert Creditors screen will be in the list. Click on it to add further detail to the currency record.

Currencies tab. For a new creditor, the Default Currency which was added on the Insert Creditors screen will be in the list. Click on it to add further detail to the currency record.

-

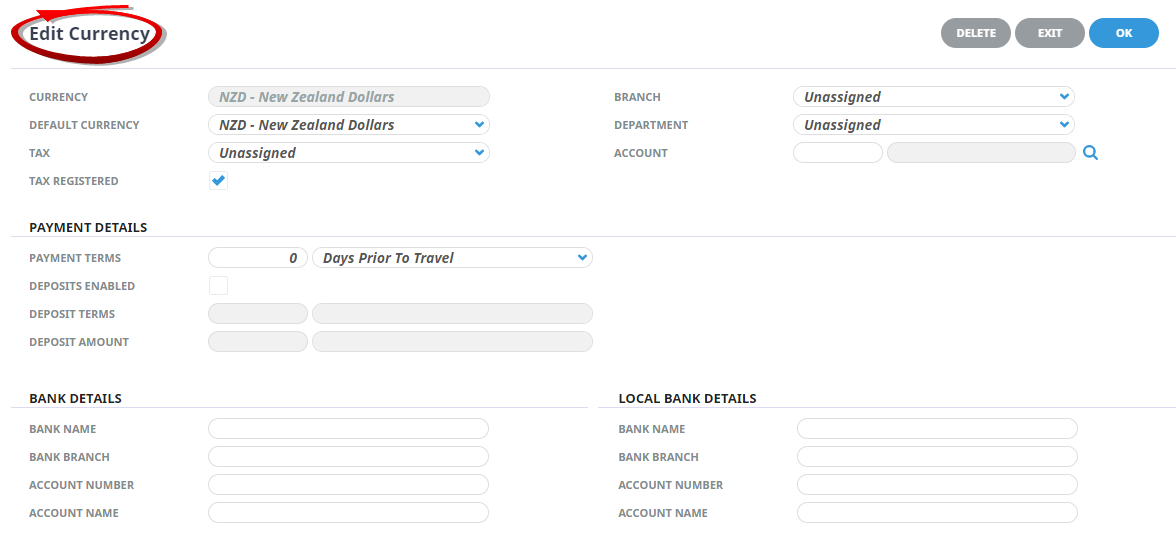

On the

Edit Currency screen, enter details into fields as required.

Edit Currency screen, enter details into fields as required.

-

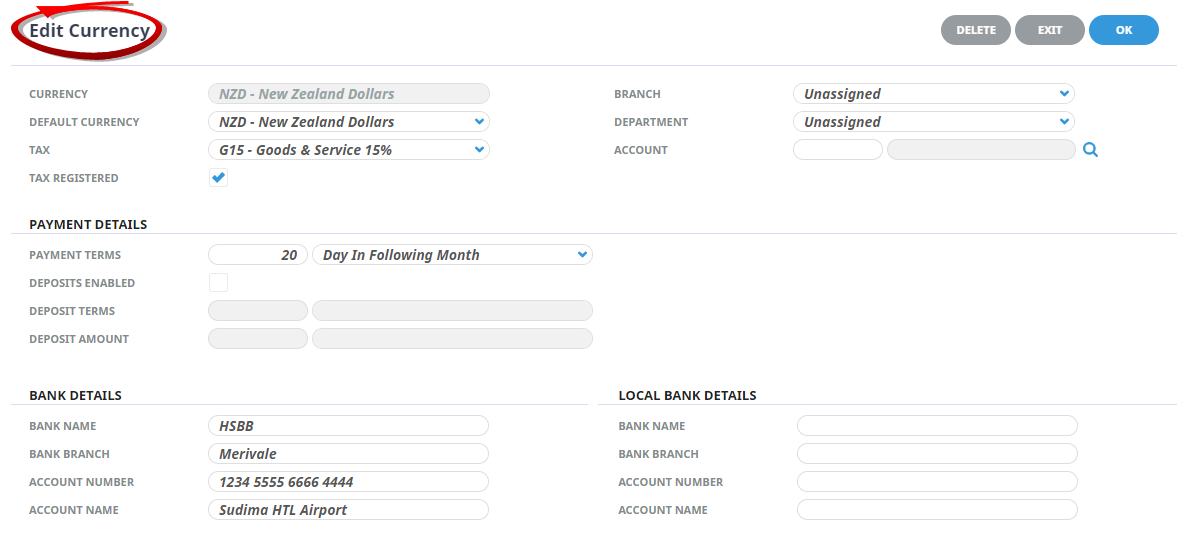

Check the

completed screen.

completed screen.

-

Click

OK to keep the changes and save or update the entry.

OK to keep the changes and save or update the entry.

-

Click

Exit to discard any changes.

Exit to discard any changes.

-

Click

Insert to add a new entry.

Insert to add a new entry.

About Currency Fields

Currency Details Section

Currency

When completing the setup of the default currency which was selected on the first Insert Creditor screen, this field will display, allowing the additional fields to be completed.

When inserting an additional currency for the Creditor, available currencies display in the drop-down list. A currency can be added to the supplier individually by selecting it.

Default Currency

Choose the currency that is going to be used most of the time for this supplier. This becomes the default and it can be overridden at transaction entry time.

Tax

Available taxes that have already been setup in the Code Setup application are available from the drop-down list. To attach a tax, select it.

Tax Registered

This flag determines whether the supplier is registered for tax purposes. If the supplier is Tax Registered, this box must be checked and the payment of input tax is the responsibility of the supplier being set up or worked on.

If the supplier is not tax registered, then this box must be unchecked and the collection and payment of any input tax component becomes the responsibility of the Tour Operator. This flag automatically makes the correct calculations depending on whether it is checked or unchecked.

Branch / Department / Account

These three fields can be used to attach a GL expense account that all expenses generated by the supplier can be posted to. Saving expense account details into these fields is only used where the supplier is not a Booking Supplier, i.e. a sundry supplier, and will never be paid for bookings-related expenses, e.g. phone company, rent etc, and the G.L. Expense Account for that supplier is always the same.

Payment Details Section

Payment Terms

There are two fields which make up the payment terms for the supplier. The first is a numeric value which is either a) a number of days or b) a date in the month depending on which setting is chosen from the drop-down list in the second field. Combined, these are used to calculate the payment due date of a suppliers invoice transaction. The available options are:

|

No. or Date |

Condition |

Example (20) |

|---|---|---|

| Date | of following month | 20th of month following invoice date. |

| Date | of current month | 20th of the month of the invoice. |

| nn days | After invoice entry | 20 days after invoice entry. |

| nn days | After invoice | 20 days after invoice date. |

| nn days | After service | 20 days after service date. |

| nn days | After travel | 20 days after booking travel date. |

| nn days | Prior to service | 20 days prior to service date. |

| nn days | Prior to travel | 20 days prior to booking travel date. |

Deposits Enabled

When checked, the Deposit Terms and Deposit amount fields become live.

Deposit Terms

This combination of integer and drop-down field is used to determine if a deposit or pre-payment is required to be made to the supplier. If the Deposit Enabled box is checked, then the other fields are enabled. The first field is a numeric value that indicates the number of days that the second field describes.

The numeric value (nn) applies as follows:

|

No. of Days |

Condition |

Example (7) |

|---|---|---|

| nn days | Days after entry | 7 days after service entry. |

| nn days | Days prior to service | 7 days prior to service. |

Deposit Amount

If deposits are being used, a save cannot be performed unless all 4 deposit fields have values in them.

The deposit amount works in conjunction with the drop-down and can be either an Amount or a Percentage.

Value Condition Example:

- 100.00 - Amount Based - $100.00.

- 10.00 - Percentage Based - 10% of the service cost.

Bank Details Section

Bank Name / Bank Branch / Account Number / Account Name

These fields can be used to store the Supplier bank account details. The Bank, Bank Branch and Bank Account fields can be output on supplier messages and as well, the Bank Account field can be used in an Electronic Payment file.

NOTE: Tourplan can generate an output file that can be processed through bank software. To use the EFT payment feature, the banks EFT file processing software and the necessary internet connections to the bank are required. (Not available in all countries). If EFT is used , then the entries in these three fields must match the requirements of banks import software.

Local Bank Details Section

Bank Name / Bank Branch / Account Number / Account Name

These fields can be used to store Local Supplier bank account details. The Local Bank, Bank Branch and Bank Account fields can be output on supplier messages and as well, the Local Bank Account field can be used in an Electronic Payment file.

Supporting Information

See also Currency Columns from within Debtors or Creditors in the appendix.