Processing a Period End

The goal of this topic is to learn the steps required to follow to complete a month end process including how to :

- do the rebuild of debtors, creditors and the GL

- check and generate accounts reports

- check the balances of the GL accounts

- close the period for debtors, creditors and the GL

- run the Forex for debtors and creditors

- issue Agent Statements

- lock the GL period

- close bookings

- close vouchers

Step 1 - Rebuild the Debtor, Creditor and GL Accounts

The first step is to run a re-build for each ledger to ensure that the balances are equal to the transactions shown.

The period rebuild double checks the integrity of all transactions and balances correcting any discrepancies that are detected. While not strictly necessary it is a good health check of your accounting records,

Re-build Accounts.

- Rebuild the Subsidiary Ledgers and the General Ledger.

- Open Financials > Accounting.

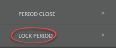

- Rebuild Debtors.

- Click the check box to 'Rebuild All Debtors'.

-

Click

Save.

NOTE: At month end, you rebuild for all Debtors.

Save.

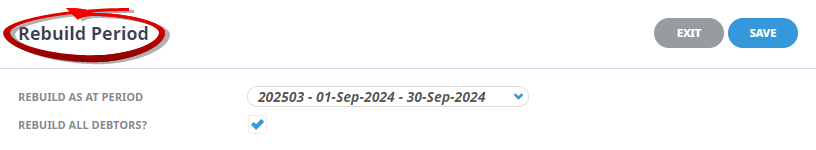

NOTE: At month end, you rebuild for all Debtors. - Rebuild Creditors.

- Click the check box to 'Rebuild All Creditors'.

-

Click

Save.

NOTE: At month end, you rebuild for all Creditors.

Save.

NOTE: At month end, you rebuild for all Creditors. -

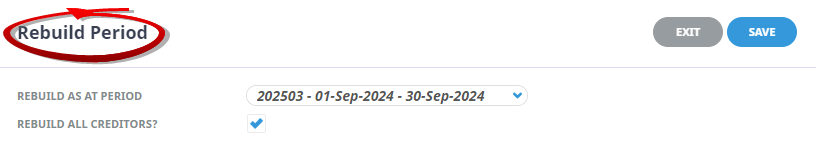

Rebuild the General Ledger -

NOTE: For the GL do not enter any period, leave as blank.

-

Open

General Ledger > Rebuild.

General Ledger > Rebuild.

- Leave it blank for all the General Ledger Accounts.

-

Click

Save.

Save.

-

NOTE: For Debtors and Creditors the system will default to the current open period, do not change. For more information on the re-build click Accounting Period Rebuild.

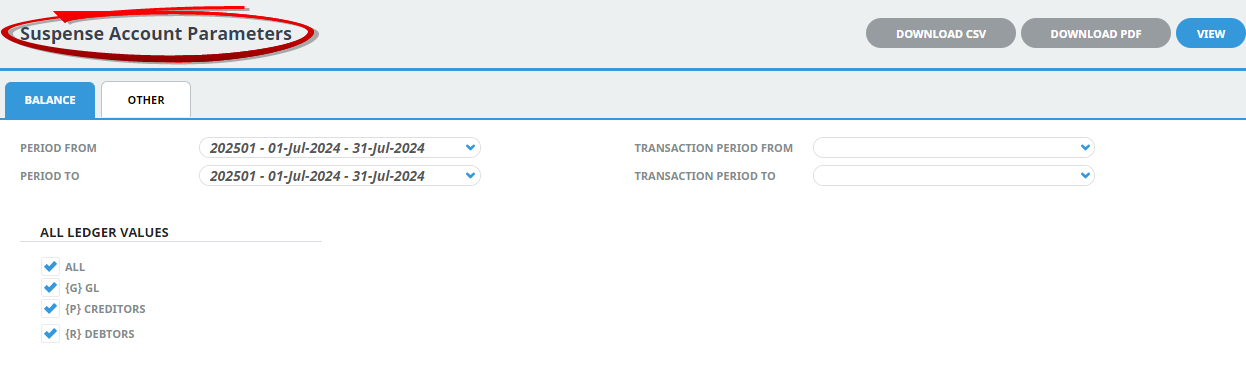

Step 2 - Run the Suspense Report

The suspense account report should now be run to see if there are any transaction which may have been miss-posted. This step allows us to correct any errors before we close the periods.

Running a suspense report

-

Check that the Suspense Report is clear.

- Select the transaction 'Period From/To' to be the Debtors & Creditors period that you are closing.

- Download, print or view the suspense account report.

The suspense account exists to accumulate transactions that do not have valid GL posting accounts. If any system generated transactions exist in the suspense account the problem for why they are in suspense must be diagnosed and corrected prior to closing the month. Any manual GL journals into the suspense account are your responsibility to reverse out prior to month end.

Tip: If a transaction is in an open period, you can simply delete it and re-raise it. This can be helpful during new system implementation when you may have neglected to create some of the required GL accounts before entering and related transactions. - Check that the balance for the Tourplan System Suspense Account is Zero.

NOTE: If you go to the transaction tab you will see which transaction is making up the balance.

- Check that all the System 'Future' accounts have a Zero Balance for the last defined period.

| Creditors Foreign Exchange (unrealised) | |

| Creditors Future Cash | |

| Debtors Foreign Exchange (unrealised) | |

| Debtors Future Cash | |

| Future Commission | |

| Future Expense | |

| Future Expense Tax | |

| Future Revenue | |

| Future Revenue Tax |

Step 3 - Accounts Receivable / Debtors Procedures

- Check for uninvoiced / under invoiced bookings.

Use either the Tour Summary Report” or the “Tour Financial Summary” to establish any bookings which have not been fully invoiced during the month you are closing. Take appropriate action prior to closing.

- Once A/R Invoicing and Receipt processing is completed for the month, check your AR Trial Balance Current Total against the General Ledger AR Control account. You will need to account for any unallocated cash – any receipt amounts not allocated to a specific invoice – by aggregating the A/R Control and the Unallocated Cash accounts.

- Or you can run a report.

NOTE: In the Other Tab, un-tick the 'Show Future Balances'.Current Total

Currency _______ Debtors Control Account Number Debtors Unallocated Cash Account Number Debtors Control Balances Currency _______ Debtors Unallocated Cash Balance Currency _______ - Fill in the' Account Code From' as the Debtors Control Account and the 'Account Code To' as the Debtors Unallocated Cash.

- View on screen, or download to CSV or PDF file.

- Reconcile any discrepancies before proceeding.

- Run the Period Close for Debtors. (All Users Should be Logged out during this process)

- The 'Period To Close' will default to the current Debtors Period. The 'New Current Period' will default to the next defined period from the System Setup Calendar.

- Click

Save.NOTE: This is just for the Debtor, the General Ledger is still open.

Save.NOTE: This is just for the Debtor, the General Ledger is still open.

If working with foreign currencies, you must now run the Foreign Exchange Variations. This will transfer any variations based on forex timing differences between date of invoice and date of receipt. These become realised forex gains or losses from fully balanced items to your nominated foreign exchange loss or gain account in the General Ledger.

Foreign exchange loss/gain will also be calculated on any open items if they were entered into the system at a different rate of exchange than the current rate at this period end. The entry however will be reversed in the now current period as it is an 'unrealised' loss or gain.

- Run the Debtors Forex for the period just closed.

Change the period back to the period you just closed and tick all currencies.

NOTE: The exchange rate that will be used to calculate the forex for the un-realised items is the rate found in your system currency between the nominated currency and your base rate. This can be manually changed at this point if this is required.

- Once you click Save you will see the system processing each foreign currency.

- Issue Agent Statements for the New Month.

- Tick the 'Agents' and click 'Generate'.

NOTE: Tourplan will generate a statement for each currency.

You can also run these accounts separate by making the from and to the same if there are accounts between these two.

|

Current Total |

Currency _______ |

Step 4 - Accounts Payable / Creditors Procedures

- Check for un-vouchered bookings.

- View on screen, or download to CSV or PDF file.

Booking Value Total Sales Costs Vouchered Actual Expected Current Profit PP Received Paid Balance - Compare the AP Aged Trial Balance for the period you are about to close to the GL Balance for the Accounts Payable Account.

Either

- Or you can run a report.

NOTE: In the Other Tab, un-tick the Show Future Balances.Current Total

Currency _______ Creditors Control Account Number Debtors Control Balances Currency _______ - Fill in the 'Account Code From and To' as the Creditors Control Account.

- Run the Period Close for Creditors. (All Users Should be Logged out during this process)

- Tick the check-box.

- The 'Period To Close' will default to the current creditors period. The 'New Current Period' will default to the next defined period from the System Setup Calendar.

- Click

Save.NOTE: This is just for the Creditor, the General Ledger is still open.

Save.NOTE: This is just for the Creditor, the General Ledger is still open.

If working with foreign currencies, you must now run the Foreign Exchange Variations. This will transfer any variations based on forex timing, the differences between date of invoice and date of payment. These become realised forex gains or losses from fully balanced items to your nominated foreign exchange loss or gain account in the General Ledger.

Foreign exchange loss/gain will also be calculated on any open items if they were entered into the system at a different rate of exchange than the current rate at this period end. The entry however will be reversed in the now current period as it is an 'unrealised' loss or gain.

- Run the Creditors Forex for the period just closed.

- Change the period back to the period you just closed and tick all currencies.

- Once you click 'Save' you will see the system processing each foreign currency.

NOTE: The exchange rate that will be used to calculate the forex for the unrealised items is the rate found in your system currency between the nominated currency and your base rate. This can be manually changed at this point if this is required.

Step 5 - General Ledger Procedures

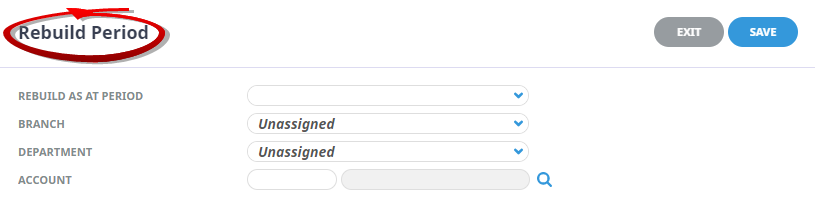

- As soon as both Debtors and Creditors have been closed lock the current period for the GL.

To read more on why we use the Lock (G.L.) Period click on the link for more information.

- Tick the check-box.

- The 'Locked Period' and 'Period Lock' will default to the current General Ledger Period.

- Click

Save.

Save.

- Raise an accrual for your Cost of Sales - Outstanding Vouchers.

- Raise an Accrual Journal - refer to Journals previously discussed in this document.

- Process any necessary Journals.

- Refer to Journals previously discussed.

- Complete the Bank Reconciliations.

- Refer to Bank Reconciliation Course Notes or the Accounts 2 User Manual.

- Check that the General Ledger Trial Balances. (GL Trial Balance)

- YTD Balance Report Total should be Zero.

- From the previously generated Debtors Trial Balance report check:

- That the balance showing for the column headed 'Total' Agrees to the General Ledger YTD Balance for the same period to the Debtors Control added with the unallocated cash.

- From the Creditors Trial Balance Report check:

- That the AP Aged Trial Balance agrees to the General Ledger Creditors Control Account.

- Run Period Close for the General Ledger.

- Once you have reconciled your bank account and entered all journals for the period you can now close off the General Ledger and move into the new accounting period.

- Tick the box.

- The 'Period To Close' will default to the current General Ledger Period. The 'New Current Period' will default to the next defined period from the System Setup Calendar.

- Click

Save.

Save.

| Outstanding Nett Total | Currency _______ |

You should now double check that your Creditors Ledger and Debtors Ledger are in balance with your General Ledger Creditors and Debtors Control Account (note to adjust the balance for unallocated cash).

Recommended Procedures

Close Bookings

This will prevent historical bookings from being edited or changed. For more information on closing bookings see the topic Close Bookings.

- Close Bookings (for example, all bookings with a travel date more than 3 months ago).

- Fill in the Filters.

- Click 'Search' or open the 'Results Tab'.

- 'Select All' button or use the 'Check-box' to the left of the screen on the table heading of the Results tab.

-

Click

Close Bookings.

Close Bookings.

Close Vouchers

For more information on closing vouchers please see the topic Close Vouchers.

- Close Vouchers (For example, all outstanding vouchers older than 6 months).

- Fill in the Filters.

- Click 'Search' or open the 'Results Tab'.

- 'Select All' button or use the 'Check box' to the left of the screen on the table heading of the Results tab.

-

Click

Close Vouchers.

Close Vouchers.