Price rules govern how pricing is done for First Charge Units (FCUs) and Second Charge Units (SCUs).

The following discussion describes the concepts of FCU and SCU, as indicated in the Price Rules tab for a product.

First Charge Unit (FCU)

The idea of Costs Charged Per is important because it determines how costs are charged throughout Tourplan NX. Called the First Charge Unit (FCU), it defines what the prime basis of charging is; e.g. Costs Charged Per Room.

Room and Person

There are two reserved words for the First Charge Unit – Room and Person. When these are used in the FCU field, Tourplan knows how to handle the charging:

- In the case of Room, the system knows how to calculate the required number of rooms based on passenger numbers, room types and configurations.

- In the case of Person, where Service Category is Accommodation, Tourplan uses this specific word to calculate accommodation costs on a Per Person basis rather than a Per Room Basis. If any word other than Room or Person is used in the FCU field, the system deems the charging basis to be Per Group.

FCU Example - Accommodation Products

- For standard type accommodation, this would normally be Per Room.

- If the accommodation supplier has provided rates on a Per Person basis, then the FCU can be Person.

- Accommodation rates can be entered on a Per Room or Per Person basis, regardless of what the First Charge Unit is.

- The documentation output from bookings can be set up to be either Room or Person based.

- For apartment or dormitory style accommodation, this could be Per Aptmnt or Per Dorm.

FCU Example: Non-Accommodation Products

There is a very simple rule for defining the First Charge Unit for Non-Accommodation services - whatever type of service they might be:

- If the supplier is charging on a Per Person basis, the First Charge Unit will always be Person.

- If the supplier is charging by (e.g.) Per Coach, then the First Charge Unit should try to reflect the supplier's charge basis: Coach, Car, Camper, Guide etc.

With only 6 characters available in this field, some creativity may be required to convey an accurate description of what the first charge unit description is.

Second Charge Unit (SCU)

The field Per is called the Second Charge Unit (SCU). It is used to label the field where a quantity is being entered and further qualifies the FCU; e.g. per Room (FCU), Per Night (SCU).

In the case of accommodation, the FCU description could be Rooms and in a booking, the number of rooms is known based on the pax numbers, room types etc. What the system needs to be told is how many nights (SCU) that the room is to be costed/reserved for.

SCU Example: Accommodation Services

- For accommodation, this will most likely be Night, regardless of the type of accommodation. It will always be a unit of time based on the pricing that the supplier has provided.

- If the pricing is supplied based on nights, then Night is the correct unit description.

- If the pricing is given as (e.g.) Per Week (for example, an apartment on a weekly basis) then the SCU will be Week (a day room could be Day).

- If more than one SCU is booked, the system will automatically append s to the SCU description; e.g. Nights or Weeks.

SCU Example: Non-Accommodation Services

- For same day services - e.g. Admissions, Sightseeing, Ferry, Cruise, Transfer, Flight, Meals etc, it could be Visit, Tour, Walk, Entry, Cruise, Trip, Game, Meal, Lunch, Dinner, Lunch, Show, Ride, Taste, Flight, etc.

- Rental Vehicles: Day.

- Extended Touring will depend on supplier pricing. If the Tour/Cruise is (e.g.) 12 Days, then Per Tour or Cruise can be used and the How Many 24 Hour Periods in a Night field can be used to indicate the duration.

Configure Price Rules for a Service

- Make sure the product has already been created (see Insert an Accommodation Product).

- If the product is not already displayed, retrieve it (see Searching for Products or Suppliers).

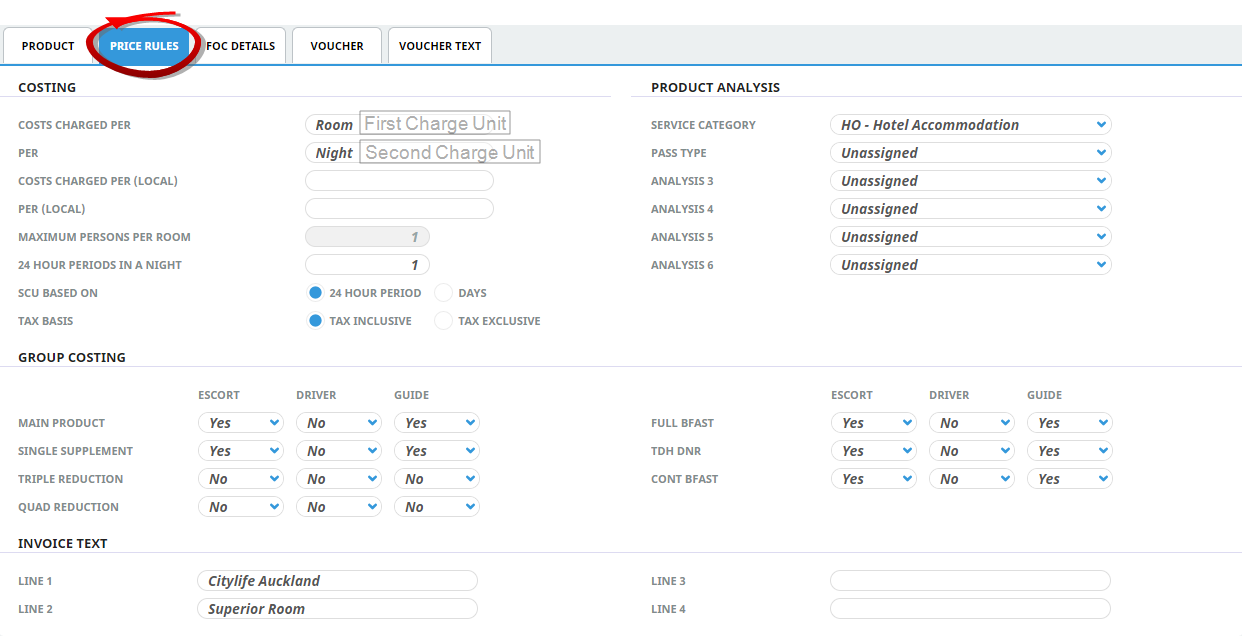

- Identify the tab containing the fields you need to modify for the product. For this example, click Product Details > General the Price Rules tab.

-

Add details to theFeel free to add your own price rule configurations.

Price Rules tab fields.

Price Rules tab fields.

-

To keep the changes, click

Save.

Save.

-

Click

Discard to discard all changes.

Discard to discard all changes.

About the Price Rule Tab Fields (Costing)

Costs Charged Per

This is the FCU (first charge unit); e.g. Room.

Per

This is the SCU (second charge unit); e.g. Night.

Maximum Persons Per <FCU>

A quantity used for other services to determine maximums.

Example: Max Persons per Room

Rental Cars FCU is Car. Maximum Persons Per Car 4. If there are 6 pax in a booking and this service was selected, the system would cost in two cars. Similarly, for a Charter Coach Service, if the maximum number of pax in the coach is 46, then enter that in this field.

How Many 24 Hour Periods in a <SCU>

This field is used to generate an end date for a service. When this is a value other than 0, it triggers the use of the SCU Based On field. Most accommodation services would probably have a value of some sort in his field and that value is driven by the Second Charge Unit (SCU). If the SCU is Night then the value in this field would be 1, meaning that when the service was used in a booking for, say, 3 Nights, the system would add 1 to the last date to get the out date to print on vouchers.

Example: How Many 24 hr Periods in a Night

If the stay was on 01 April, then the 3 Nights would be 01 Apr, 02 Apr and 03 Apr, but the voucher would be able to print In 01 Apr – Out 04 Apr. If the accommodation was Per Room Per Week (meaning that the pricing is being entered as a weekly rate), then this field would have 7 in it.

When the service was subsequently used in a quote or booking, the number of Second Charge Units entered would be the number of weeks; e.g., 2 = 2 Weeks = 14 Days. The system would automatically calculate the 15th day as the out date.

SCU Based On

Used to determine the charging basis for the Second Charge Unit – in the case of accommodation: 24 Hour Period.

It has no effect on accommodation services, but is used for those services; e.g. some Rental Vehicle products, which are charged by Days rather than a 24 Hour Period.

Tax Basis

Are the rates that will be entered for this Service inclusive or exclusive of taxes?

The system does not care whether rates are entered on a Tax Inclusive or Tax Exclusive basis. How the rates are entered in the Services database has no bearing on how tax is handled for accounting or service calculation purposes. It is recommended, however, that a consistency is maintained; i.e. either all Tax Inclusive or all Tax Exclusive.

The main reason for this is when consultants are required to manually enter a rate during the booking process – because the rate has expired, or it’s a ‘manual rate’ service, or a special price has been given – then they need to know to check on the manual rate entry screen that will display whether the values they are entering are to be Tax Inclusive or Tax Exclusive.

There is a strong argument toward Tax Inclusive, since rate rounding can take place in the Services database and if Tax Exclusive rates are rounded at this level, then when used in a quote or booking and the tax is then added to them, any rounding is lost. Similarly, if the Distribution Edition Internet booking system is being used, services flagged as being Tax Exclusive will display on web sites as tax exclusive.

Product Analysis

Select analysis codes from the drop-down lists. These codes must have been previously defined in the Code Setup application. The codes are used to filter reporting and can also be used to filter services in the Bookings.

Example: Product Analysis

These fields could be used to differentiate accommodation passes from an accommodation wholesale supplier; e.g. BW Blue Accommodation Pass or CC Gold Pass or BW Silver Accommodation Pass. They could also be used to subdivide a Service Type; e.g., accommodation into Hotels, Motels and B&B Houses.

Group Costing

This section defines default settings for when and how Product and Extras costs are automatically applied by Tourplan in quotes and group bookings when escorts and/or drivers and/or guides are using the product.

NOTE: These settings should be considered in isolation from any Free of Charge (FOC) components of the service that may be offered by a supplier. The FOC Details screen allows the setting up of FOC thresholds. These settings apply when a) no FOCs are applicable or b) up to the point where the threshold applies.

There are separate sets of defaults for Escorts, Drivers and Guides and each default setting includes three possible answers:

| Selection | Effect |

|---|---|

| Yes | Escort/driver/guide will be included in the total Pax count and cost only if the service component is used by Pax |

| No | Escort/driver/guide will NOT be included in the total Pax count and cost if the Extra is being used by Pax |

| Always | Escort/driver/guide will ALWAYS be included in the total Pax count and cost even if the Pax are not using the service component. |

Examples of using Always:

Example 1

- A group overnights in an area where all driver/guide expenses have to be met. The groups accommodation is based on Room Only but an invoice will be received for DBB for the driver/guide.

Breakfast and Dinner are setup as extras and if Always is used in the extras fields against the driver/guide then the system will always add in the costs of Dinner and Breakfast for the Driver and Guide regardless of whether the rest of the group is having the meals.

Example 2

- Scheduled Tours where driver and maybe guide need to have certain extras always costed (e.g. breakfast) even if the passengers don’t have the breakfast.

NOTE: A problem in this scenario is, if the extra is set to Always then if the product is used in quotes/bookings that are not scheduled tours, the extra would also be costed in. If the product is setup specifically for a scheduled tour, then it could be done without repercussions in other quotes / bookings.

Example 3

- If an establishment offers half price rather than full FOC for Escort, Driver, Guide.

Define a minus $ extra against the product for the amount of the Escort/Driver/Guide discount and set apply cost to Always for Escort, Driver and Guide.

The extra would not be selected for the passengers, but if there is an Escort, Driver or Guide the discount would automatically be applied.

Invoice Text x 4

These are four additional lines of text which can be output on documentation. Their primary purpose is to provide a description that will be used as an accounting transaction description, and can (provided the invoice document is setup to include it) appear on an agent invoice when the product is used in a booking.

- Line one defaults to the supplier’s name but can be overridden.

- Line two defaults to the product description, and can also be overridden.

- Line three and four are blank and can be used as additional or alternative text on invoice messages, these fields can also be overidden when raising an invoice.